Your Guide to Cross-Border Shopping

Shopping across the border of Canada and the US? Wondering what the duty from USA to Canada is, or what you have to pay when you cross the border from Canada to US? Our cross-border shopping guide will let you know:

Shopping across the border of Canada and the US? Wondering what the duty from USA to Canada is, or what you have to pay when you cross the border from Canada to US? Our cross-border shopping guide will let you know:

- How much you can buy without paying extra in duties

- What the duties are once you buy more than the personal exemption

- Which American states and Canadian Provinces to visit for the lowest tax rates

- How to pay an American price for a car you’ll drive in Canada

- How to get a tax refund if you visit an eligible state or…

- Which type of Canadian vacation makes you eligible for a tax refund and how to get one

- How to recover the taxes paid on American gambling winnings

Know before you go

Duty from USA to Canada, Duty Free from Canada to USA

Check out our convenient cross border shopping chart. Print and save a copy to bring with you when you’re traveling! Coffee-proof laminate not included.

PERSONAL EXEMPTIONS FOR CANADIANS RETURNING FROM THE US

DUTY-FREE EXEMPTIONS FOR AMERICANS RETURNING FROM CANADA

Big spender? Planning to buy more than your personal duty-free exemption allows? Here’s what you can expect to pay:

DUTIES FOR AMOUNTS OVER THE PERSONAL EXEMPTION

DUTY RATES WHEN RETURNING TO CANADA |

DUTY RATES WHEN RETURNING TO THE US |

| 7% + GST/HST (ON GOODS VALUED UP TO $300 ABOVE PERSONAL EXEMPTION EXCLUDING ALCOHOL AND TOBACCO) |

3% (FOR UP TO $1000 ABOVE PERSONAL EXEMPTION) |

| VARIABLE IMPORT DUTY RATES APPLY TO GOODS >$300 ABOVE EXEMPTION |

VARIABLE IMPORT DUTY RATES APPLY TO GOODS >$1000 ABOVE EXEMPTION |

HOW TO MAKE YOUR AMERICAN HOLIDAY A TAX HOLIDAY

Goods and services in the United States are generally much cheaper than they are in Canada and Europe. Why? Lower taxes. Don’t forget that the American Revolution started with a tax revolt. Liberty from the taxman is something our neighbours to the south take pretty seriously.

There is no national American Value Added Tax, although most states, with a few notable exceptions, charge Sales and Use Taxes of varying rates. Because of the wide variety of tax rates across the US, foreign visitors are not eligible for the sizable and convenient tax refunds you find in Europe and Asia.

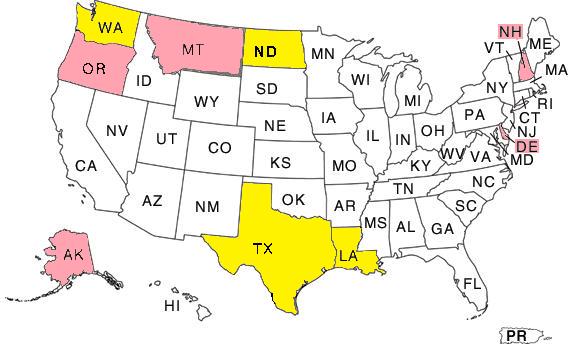

There ARE, however, limited opportunities for sales tax exemptions or refunds for Canadian and foreign travelers shopping in the US. Try these states:

Find the states where you can get your tax back

| STATE | TAX REFUNDS FOR NON-RESIDENTS | NO TAX FOR ANYONE |

| ALASAKA | X | |

| DELAWARE | X | |

| LOUISIANA | X | |

| MONTANA | X | |

| NEW HAMPSHIRE | X | |

| NORTH DAKOTA | X | |

| OREGON | X | |

| WASHINGTON | X |

Here are some state-by-state details about the sales tax refunds:

- WashingtonCanadians are permitted a sales tax exemption in the state of Washington with valid ID, but only if you are from a province or territory that does not charge provincial sales tax or HST. That means only residents of Alberta, Yukon, NWT and Nunavut qualify. You receive this exemption in person at the point of purchase by presenting your ID (usually a driver’s license or passport) to the merchant.

Also note that merchants are not legally required to offer the sales tax exemption if they decide that the extra administrative burden is more than they’re willing to assume. - TexasNon-residents will be issued a sales tax exemption at or near the point of sale, in a dedicated office or at an airport. This usually means that you visit a kiosk at an outlet mall, and it almost always means that you have to have the merchandise with you with the accompanying receipt.

- North DakotaCanadians can apply for sales tax rebates from North Dakota online or by mail.

- LouisianaAs in Texas, non-residents will be issued a sales tax exemption or refund at the point of sale, in a dedicated office or at an airport.

Unfortunately, most states do not offer sales tax refunds:

Popular travel destinations like California, Florida, and Arizona, and most border states like New York, Michigan, Vermont, and Minnesota, do not offer refunds or exemptions for foreign travelers.

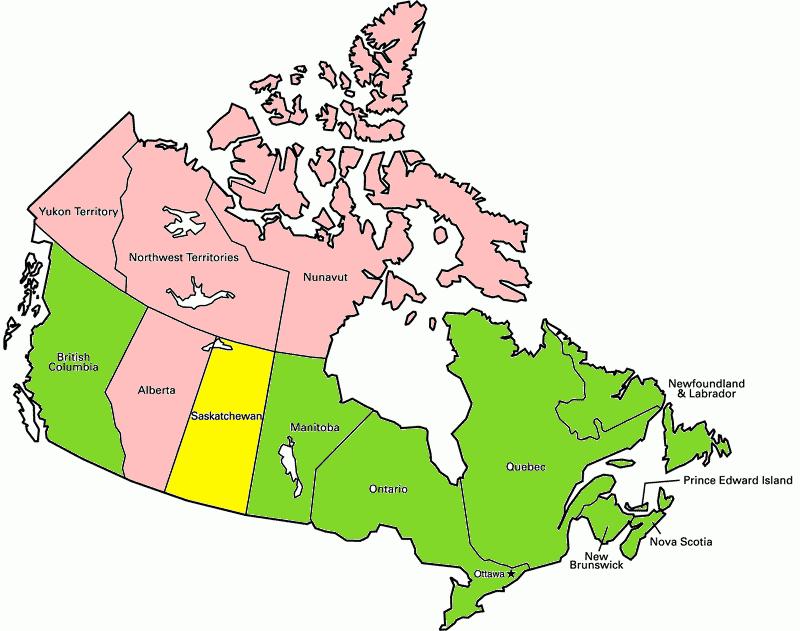

CANADIAN TAXES FOR AMERICANS AND OTHER FOREIGN SHOPPERS

It’s true that Canadians generally pay more in sales taxes than their southerly neighbours, but not quite everywhere: if you’re visiting Alberta or any of the three territories, you’ll enjoy a much lower tax rate than anywhere else in the country. In fact, the 5% federal Goods and Services Tax in Alberta and the territories is lower than the Sales and Use Taxes charged in many American states. Check our colour-coded map to plan your Canadian shopping trip.

Where you have to pay PST or HST in Canada

Pink provinces and territories: only GST (5%)

Yellow province: low PST + GST (10%)

Green provinces: highest HST (12-15%)

Alberta, Yukon, Northwest Territories, and Nunavut are your low-tax shopping destinations of choice, followed by Saskatchewan and everyone else. Of course, if you live on the more populous American east coast, a trip to Iqaluit might be out of the question.

HOW TO PAY AN AMERICAN PRICE FOR A CAR YOU’LL DRIVE IN CANADA

Save money by buying your car in the US

DO THE MATH.

How much time and energy are you going to have to spend on this process? How much will you save on the Canadian price of the same vehicle? The big savings are generally on luxury vehicles. Buying a Corolla? Stay local.

Does it make sense for you to both importing your car from the US?

- Make sure the vehicle is admissible to Canada. Check the Registrar of Imported Vehicles.

- Check to see if there are additional duties beyond the $195 importation fee plus GST / HST: many cars manufactured outside of North America are subject to import duties, and many cars with dated or varying emissions standards will be subject to excise levies. Check with Border Services Canada for the exact amounts.

- Make sure the vehicle is insured and registered, and that all of the other documentation is in order before crossing the border. You will need a purchase invoice, recall clearance documentation, and a statement of compliance.

Don’t forget your Recall Clearance Document

HOW TO GET A TAX REFUND FROM YOUR CANADIAN HOLIDAY

In 2007 Canada scrapped its European-style Visitor Rebate Program. Tourists and tourism industry insiders were dismayed. According to this report by the Canadian Chamber of Commerce, the Canadian government is making travelling here more expensive and therefore less attractive to international visitors. Thanks, guys.

If you are eligible, make sure you get your rebate.

There is good news: some non-resident visitors to Canada qualify for a 50% rebate of the tax they pay on their trips. You only qualify if you purchase an “eligible vacation package” at an all-inclusive price. The Canada Revenue Service has some extremely strict definitions of “eligible package,” but the two essential components are accommodation and service. A ski trip does not count if you get accommodation and lift tickets and rentals for one all-inclusive price, but it does count once you throw in some lessons, for example. Check out their annoying list for more examples. A bus tour counts if it includes accommodations and the services of a tour guide. Ask your tour provider if you qualify for a refund, and ask them if they are planning to file on your behalf. If they do, they will likely build the refund into the price upfront. If they don’t, you’re on your own to apply. Here’s how:

- Submit a GST115 form, your original receipt/invoice, and a copy of a detailed travel itinerary.

- Wait for your refund to show up (50% of the GST/HST paid on the all-inclusive price of your “eligible package”).

HOW TO GET A REFUND FROM YOUR TAXED AMERICAN GAMBLING WINNINGS

Get your taxes back from your gambling winnings

Have you won big at an American casino? Congratulations. But look at your winnings: are you missing 30% of your prize? Yes you are. Canadians who find their winnings taxed in American casinos are eligible to receive a partial refund if they retain proof of losses to offset taxable winnings. Keep your receipts! Here’s how to get your money back:

- Canadians must obtain an ITIN (US Individual Taxpayer Identification Number) by filing form W-7 (requiring proof of ID) along with a non-resident US tax return form, 1040NR.

- You must have proof of losses that offset your winnings. You file these forms at US tax time in April.

- That’s it! Sit and wait for your money to return to you.